Table of Contents

One of the most critical decisions for an online store owner is selecting the right payment gateway. A payment gateway is a technology that enables businesses to accept payments securely from customers, ensuring that transactions are processed quickly and efficiently. With so many options available, choosing the right one for your eCommerce business can be overwhelming. The right payment gateway will not only provide a seamless checkout experience but also ensure that both you and your customers are protected from fraud and data breaches. This guide will walk you through the essential factors to consider when selecting a payment gateway for your online store.

Understanding What a Payment Gateway Does

Before diving into the selection process, it’s essential to understand the basic role of a payment gateway. A payment gateway acts as a bridge between your eCommerce website and the bank, authorizing and processing online transactions. It encrypts sensitive information, such as credit card numbers, to ensure that data is transferred securely from the customer to the bank and back. Without a reliable payment gateway, you risk losing customer trust and sales due to poor transaction experiences.

Factors to Consider When Choosing a Payment Gateway

Choosing a payment gateway involves more than just picking a popular option. The right solution will depend on a variety of factors, including your business needs, target audience, and technical capabilities.

Payment Gateway Fees and Costs

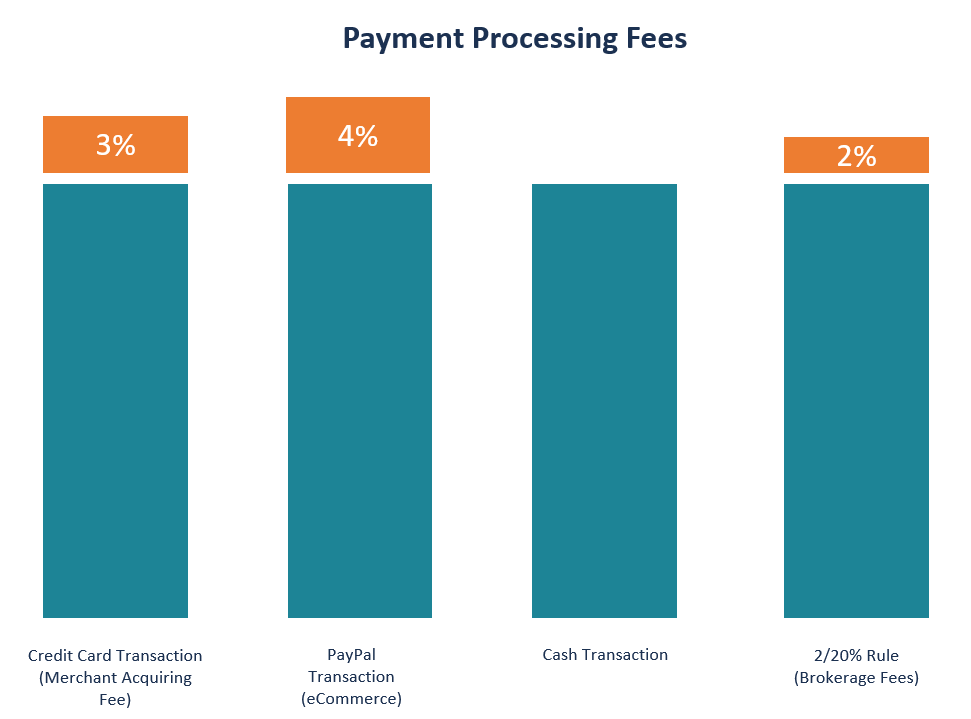

Different payment gateways come with varying fee structures, which can significantly impact your bottom line. Typically, fees include setup costs, monthly fees, transaction fees, and sometimes chargeback fees. Compare the pricing of multiple providers to see which fits your budget and volume.

Transaction Fees

Most gateways charge a fee for each transaction processed. This is usually a percentage of the transaction amount, plus a small fixed fee (e.g., 2.9% + $0.30 per transaction). If your store handles a high volume of small transactions, these fees can add up quickly, so be sure to factor them into your pricing strategy.

Additional Fees

Some gateways may charge additional fees for features like international transactions, recurring payments, or advanced fraud protection. Be mindful of these extra costs and only pay for features that add value to your business.

Security and Fraud Prevention

Security is a top priority for any online business. The payment gateway you choose must be PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that all payment data is processed securely. Look for features like tokenization and 3D Secure authentication, which add extra layers of protection against fraud.

PCI Compliance

PCI compliance is a set of security standards that all businesses handling credit card data must follow. Choosing a PCI-compliant payment gateway reduces the risk of data breaches and helps protect your business from fines associated with non-compliance.

Fraud Detection Tools

Some payment gateways offer built-in fraud detection tools, such as address verification systems (AVS) and card verification value (CVV) checks. These tools can help identify suspicious transactions and reduce the risk of chargebacks, saving you time and money in the long run.

Compatibility with Your Platform

Not all payment gateways are compatible with every eCommerce platform. Before making a decision, check whether the gateway integrates seamlessly with your online store. If you’re using platforms like Shopify, WooCommerce, or Magento, you’ll want to choose a gateway that’s easy to set up and works smoothly with your existing systems.

Custom Integrations

If your store is custom-built or runs on a less common platform, you may need a gateway that offers API integrations. Make sure the provider offers comprehensive documentation and technical support to help with the integration process.

Mobile Compatibility

With more consumers shopping on mobile devices, your payment gateway should also be optimized for mobile payments. Ensure that the gateway provides a mobile-friendly checkout experience, which can help reduce cart abandonment and improve the overall shopping experience for your customers.

Supported Payment Methods

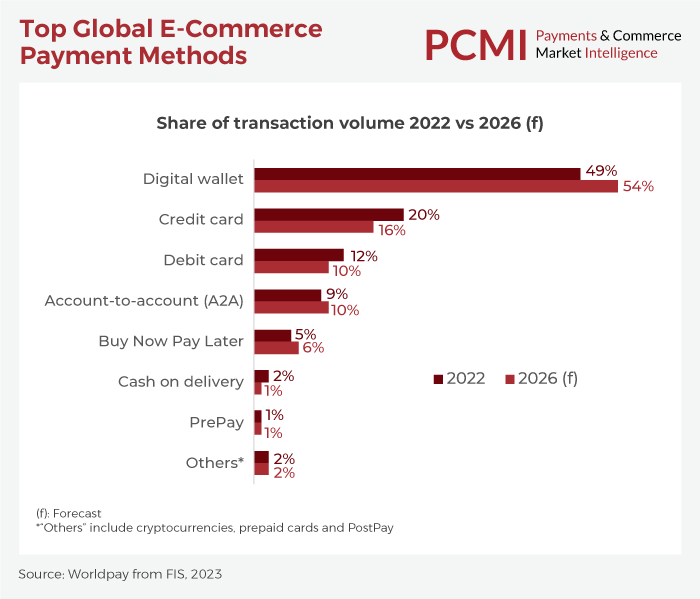

Your payment gateway should support a variety of payment methods to accommodate different customer preferences. While credit and debit cards are standard, consider gateways that support digital wallets (e.g., PayPal, Apple Pay, Google Pay), bank transfers, and even buy-now-pay-later options. The more options you offer, the easier it is for customers to complete their purchases.

Global Payment Options

If you have an international customer base, choose a gateway that supports multiple currencies and local payment methods. Offering localized payment options can significantly improve your conversion rates in different markets by making the checkout process familiar and accessible.

Recurring Billing and Subscriptions

If your business model involves recurring billing or subscription services, make sure the payment gateway offers these features. Automated recurring billing saves time and ensures a smooth customer experience, which is critical for retaining subscribers.

Customer Experience and Checkout Process

A smooth and intuitive checkout experience is crucial for reducing cart abandonment and improving sales. Choose a payment gateway that offers a simple, user-friendly interface and minimizes the number of steps required to complete a purchase.

Hosted vs. Non-Hosted Gateways

Hosted gateways redirect customers to the provider’s page to complete the transaction, while non-hosted gateways keep the entire checkout process on your site. While hosted gateways are simpler to set up and offer added security, non-hosted gateways provide a more seamless experience but require stricter security measures.

Customization Options

Look for gateways that allow you to customize the checkout page to match your brand’s look and feel. A consistent brand experience throughout the checkout process can build trust and reduce friction for customers, leading to higher conversion rates.

Reliability and Customer Support

Technical issues with your payment gateway can result in lost sales and frustrated customers. Choose a provider known for high uptime rates and reliable performance. Additionally, ensure they offer 24/7 customer support to help you quickly resolve any issues that may arise.

Service Uptime

A high uptime rate means the gateway is less likely to experience outages or downtime. Look for providers that guarantee at least 99.9% uptime to minimize the risk of payment disruptions.

Responsive Customer Support

If something goes wrong, you’ll need quick and effective support. Check whether the provider offers multiple support channels, such as phone, email, and live chat, and read reviews to gauge the quality of their customer service.

Conclusion

Choosing the right payment gateway is a crucial step in building a successful online store. By considering factors like fees, security, compatibility, supported payment methods, and customer experience, you can select a gateway that meets your needs and enhances the shopping experience for your customers. Take the time to evaluate your options carefully, and you’ll be well on your way to creating a seamless, secure, and efficient payment process for your online store.

FAQs

What is a payment gateway?

A payment gateway is a service that processes online payments for eCommerce businesses, ensuring that customer transactions are authorized and secure.

How do I know if a payment gateway is PCI compliant?

Check the provider’s website or ask their customer support team. PCI compliance is mandatory for gateways handling credit card information, and reputable providers will be upfront about their compliance status.

Which payment gateway is best for small businesses?

It depends on your specific needs. PayPal and Stripe are popular choices for small businesses due to their ease of use, affordable pricing, and flexibility.

What fees should I look out for when choosing a payment gateway?

Watch for setup fees, monthly fees, transaction fees, chargeback fees, and fees for additional features like advanced security or international payments.

Can I switch payment gateways later if needed?

Yes, but switching gateways can involve technical adjustments and potential downtime. Choose a gateway that offers scalability and flexibility so you don’t have to switch as your business grows.

Should I use more than one payment gateway?

Using multiple gateways can provide redundancy and give customers more payment options. However, managing multiple gateways can be complex and may incur additional fees.