Table of Contents

One of the most critical elements of running a successful e-commerce business is offering a seamless, secure, and efficient payment experience. Payment gateways act as the bridge between your customers and your business, ensuring transactions are processed securely and smoothly. However, choosing the wrong payment gateway—or not optimizing your existing one—can lead to lost sales, frustrated customers, and even security issues. In this article, we’ll explore how payment gateways can make or break your online business and offer tips on choosing the right one for your needs.

Enhancing User Experience and Reducing Cart Abandonment

A smooth and simple payment process is key to a positive user experience. If the checkout process is cumbersome or complicated, potential customers may abandon their carts, leaving you with lost sales. According to studies, cart abandonment rates can reach as high as 70%, and a confusing or overly complex payment process is one of the main culprits.

Easy and Seamless Checkout

Your payment gateway should offer a frictionless checkout experience. This includes a user-friendly interface, minimal steps to complete a transaction, and an option for guest checkout. The fewer hurdles your customers face, the more likely they are to complete their purchase.

Multiple Payment Methods

Offering a variety of payment methods is crucial for customer satisfaction. Different customers prefer different ways to pay—credit cards, PayPal, Apple Pay, Google Pay, or even cryptocurrency. A versatile payment gateway that accommodates various payment options increases the chances that a customer will complete their transaction rather than abandon their cart due to limited choices.

Mobile Optimization

In 2024, mobile shopping is dominating the e-commerce landscape, with more customers completing purchases on their phones. A payment gateway that isn’t optimized for mobile devices can result in a frustrating experience, leading to higher bounce rates. Ensure your payment gateway provides a smooth, mobile-friendly checkout experience.

Building Trust and Security with Your Customers

Security is one of the most important factors customers consider when shopping online. If your payment process appears unsecure, potential customers will hesitate to complete their purchase. On the other hand, a secure payment gateway enhances your business’s credibility and builds trust with your audience.

PCI Compliance

Payment gateways must comply with the Payment Card Industry Data Security Standard (PCI DSS), which ensures that all credit card transactions are secure. Choosing a PCI-compliant gateway helps protect customer information and reduces the risk of fraud.

Fraud Protection Features

A good payment gateway includes built-in fraud protection tools like tokenization, encryption, and Address Verification Systems (AVS). These features help prevent unauthorized transactions and protect both your business and your customers from fraud.

3D Secure Authentication

Implementing 3D Secure adds an additional layer of protection during the payment process. This authentication method requires customers to verify their identity via a password or a code sent to their phone, ensuring that only authorized users can complete the transaction. This added security can significantly reduce chargebacks and improve trust in your brand.

Impact on Conversion Rates

Your choice of payment gateway can directly influence your conversion rates. An overly complicated checkout process, limited payment options, or poor site performance can all lead to lost sales and lower conversions.

Fast and Reliable Transactions

A slow or unreliable payment gateway can lead to payment failures, causing frustration for your customers and resulting in abandoned transactions. On the flip side, a fast and reliable gateway ensures smooth, real-time transaction processing, improving the customer experience and increasing the likelihood of conversion.

Localized Payment Options

If your online business operates internationally, it’s important to offer localized payment options, such as region-specific credit cards or local currencies. A payment gateway that supports multiple currencies and local payment methods can help you cater to a global audience, making it easier for international customers to buy from you.

One-Click Payments

One-click payments, such as those offered by Amazon or PayPal, make the checkout process incredibly easy for returning customers. By allowing customers to save their payment information for future purchases, you can reduce friction, improve convenience, and encourage repeat business.

Scalability for Business Growth

As your online business grows, your payment gateway needs to be able to scale alongside you. A gateway that works well for a small startup might not be sufficient for a larger enterprise, so choosing a payment gateway with scalability in mind is essential for long-term success.

Support for High Transaction Volumes

As your business grows and traffic increases, your payment gateway should be able to handle larger transaction volumes without slowdowns or downtime. A gateway that scales with your business ensures that no matter how much your business grows, your payment processing will remain seamless.

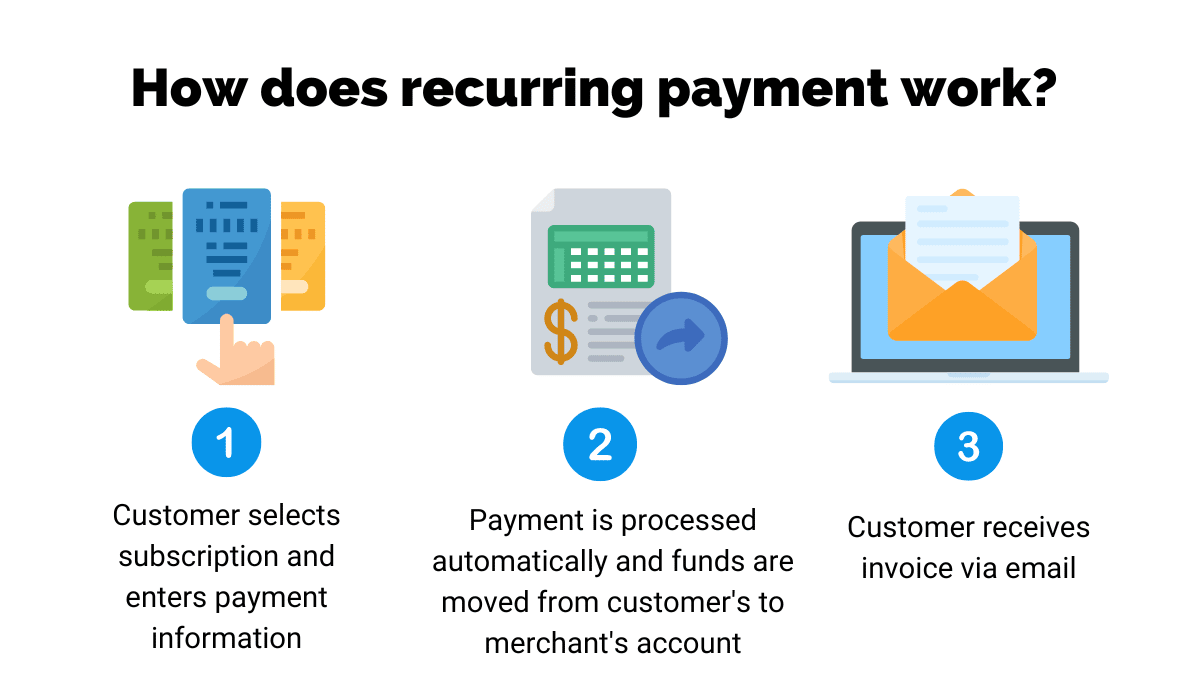

Recurring Payments and Subscriptions

If your business model includes subscriptions or recurring payments, choose a payment gateway that supports automated billing. This feature makes it easy for you to manage ongoing payments and for your customers to subscribe to your services without having to repeatedly enter their payment information.

Integration with Other Platforms

Your payment gateway should integrate easily with your e-commerce platform, accounting software, and CRM systems. This ensures a streamlined workflow and simplifies tasks such as order tracking, reporting, and managing customer relationships.

Costs and Fees That Affect Profit Margins

While functionality and security are essential, the costs associated with a payment gateway can significantly impact your bottom line. Many gateways charge fees for setup, monthly usage, transactions, and even chargebacks. Understanding the fee structure of your payment gateway is crucial to ensure that it aligns with your profit margins.

Transaction Fees

Most payment gateways charge a transaction fee, typically a percentage of the sale plus a fixed amount. For example, a gateway might charge 2.9% + $0.30 per transaction. For businesses with high sales volumes or low margins, these fees can add up quickly, so it’s important to choose a gateway with competitive rates.

Hidden Fees

Be aware of any hidden fees that may not be immediately obvious, such as fees for chargebacks, refunds, international payments, or currency conversion. These can significantly impact your overall profitability, especially if you’re unaware of them upfront.

Monthly or Setup Fees

Some gateways charge monthly fees, while others may offer a pay-as-you-go model with no setup costs. Consider your business size and sales volume when evaluating different pricing models to ensure that you’re getting the most cost-effective solution for your business.

Customer Support and Reliability

The technical side of payment gateways can sometimes be complex, and issues can arise unexpectedly. A payment gateway provider with responsive and reliable customer support is essential for resolving problems quickly and minimizing disruption to your business.

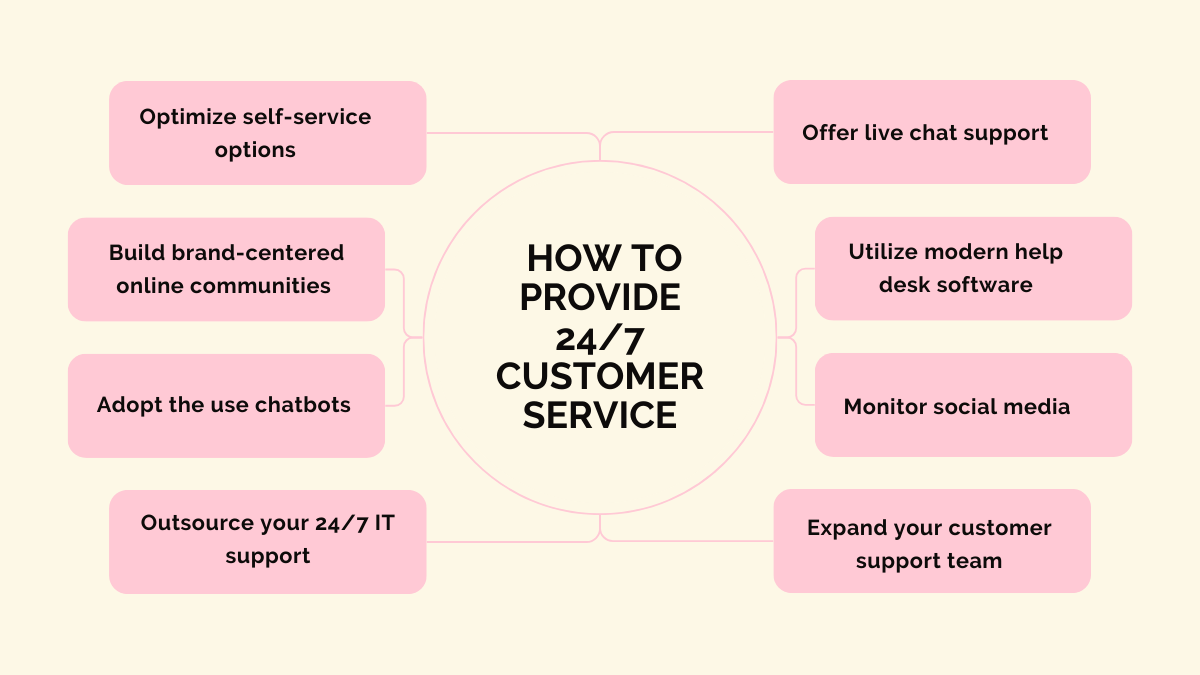

24/7 Customer Support

Choose a payment gateway that offers 24/7 customer support. This ensures that if any issues arise—such as payment failures, slow processing, or system outages—you can resolve them as quickly as possible, minimizing lost sales and customer frustration.

High Uptime and Reliability

Your payment gateway should have a high uptime rate (99.9% or more), meaning it is almost always available. Downtime during peak sales periods can result in lost revenue and damage to your brand’s reputation. Reliability is key to ensuring that your customers can always complete their transactions smoothly.

Conclusion

Your choice of payment gateway can significantly impact the success of your online business. From enhancing user experience and boosting conversion rates to providing security and scalability, the right payment gateway makes all the difference. Take the time to evaluate different options based on your business needs, transaction volume, and customer preferences. By selecting the best payment gateway, you can improve customer satisfaction, reduce cart abandonment, and ensure your business is set up for long-term growth.

FAQs

What is a payment gateway?

A payment gateway is a service that processes online payments for e-commerce businesses. It securely transmits payment information between the customer, the merchant, and the bank.

Why is a payment gateway important for my business?

A payment gateway is crucial because it ensures secure, seamless transactions. It affects your customers’ experience at checkout and can impact conversion rates, customer trust, and overall sales.

What should I look for in a payment gateway?

Look for features such as multiple payment options, mobile optimization, strong security measures (e.g., PCI compliance and 3D Secure), fast transaction processing, and competitive fees.

How do payment gateway fees work?

Payment gateways typically charge a percentage of each transaction, plus a fixed fee. Some also charge monthly fees, setup fees, or fees for chargebacks and refunds.

Can a payment gateway affect my business growth?

Yes, a scalable payment gateway can grow with your business, supporting higher transaction volumes, international sales, and recurring payments as your business expands.

What security features should a payment gateway have?

Look for PCI compliance, tokenization, encryption, fraud detection tools, and 3D Secure authentication to ensure your customers’ data is protected.